Alopna Software provides professional IT solutions including

website development, mobile app development, custom software development,

eCommerce solutions, CRM systems, UI/UX design, and digital marketing services.

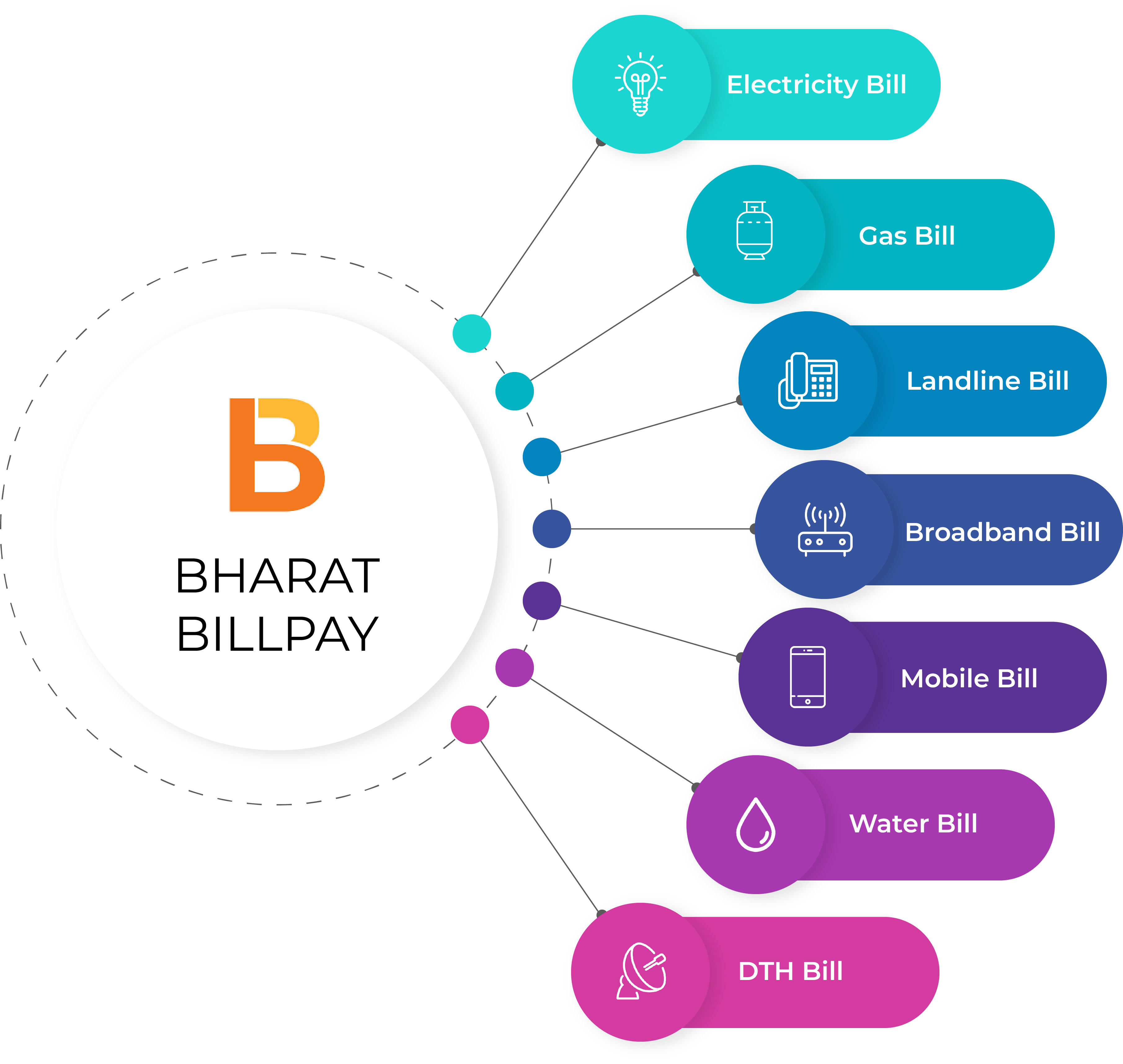

About Bbps Service

A Comprehensive Bill Payment Solution

Keeping track of monthly bill payments for several services can be difficult for both

consumers and businesses in the fast-paced world of today. BBPS Software provides a

scalable, safe, and easy-to-use platform for managing several bill payment kinds in one

integrated system. Whether it's electricity bills, insurance premiums, water bills, gas

payments, credit card repayments, or any other recurring bill, our software makes the

payment process effortless.

Our solution integrates with BBPS (Bharat Bill Payment System)—an initiative by the National

Payments Corporation of India (NPCI)—to offer real-time payment services, ensuring

convenience, transparency, and reliability for both businesses and customers.

WHAT WE OFFERING

Why Choose Our BBPS Software?

Multiple Bill Categories Supported

Electricity Bills: Pay power bills across different state providers in

real-time.

Real-Time Transaction Tracking

Users get instant confirmation receipts after payment, while businesses can

monitor transactions with detailed reports, analytics, and notifications.

Secure and Compliant Platform

The software follows PCI DSS standards and BBPS guidelines, ensuring all

transactions are encrypted and secure. Compliance with NPCI protocols is built-in.

Automated Reconciliation & Settlement

With automated reconciliation and settlement processes, businesses get

visibility into their cash flows, ensuring smooth financial management.

BBPS SERVICE

Why BBPS Will Be India's Payment System of the Future

The Bharat Bill Payment System has revolutionized utility payments by

offering a standardized and interoperable platform. As India moves towards a cashless

economy, BBPS will play a crucial role in driving financial inclusion by bringing more

billers and customers under one platform.

With government support, innovative technologies, and increasing customer

preference for digital payments, the demand for BBPS-enabled solutions is growing rapidly.

Our BBPS Software is designed to help your business tap into this potential and stay ahead

in the evolving digital payment landscape.

FAQ

Frequently Asked Questions (FAQs)

-

1. What services does Alopna Software provide?

-

2. Do you create custom software solutions?

-

3. Do you provide website maintenance and support?

-

4. Why choose Alopna Software?We focus on quality, innovation, timely delivery, and client satisfaction. Our experienced team ensures reliable and cost-effective IT solutions for your business growth.

-

5.Can you redesign an existing website?Absolutely! We can redesign your existing website with a modern UI/UX, improved performance, and better SEO optimization.

-

6. How long does it take to complete a project?Project timelines depend on the complexity and requirements. A basic website may take 1–2 weeks, while custom software or mobile apps may take 4–8 weeks or more.

-

7. What Industries Do You Serve?Alopna Software works with a wide range of industries, including healthcare, education, finance, retail & eCommerce, travel & tourism, hospitality, and more. We provide tailored IT solutions designed to meet industry-specific requirements and help businesses improve efficiency, performance, and growth.

CONTACT US

Contact Us Let’s Talk Your Any Query.

We’d love to hear from you! Whether you have questions, need

support,

or want to explore partnership opportunities, our team at Alopna Software is here to

help. Reach out to us, and we’ll get back to you as soon as possible.

Or You may Call Us For Appointment

(+91) 72399 66066